Shorouk Express

Bank of England Chief Economist Huw Pill has backed the cautious approach to interest rates set out by the bank.

On Thursday, the bank announced a cut in interest rates from 4.75 per cent to 4.5 per cent, but the economy is forecasted to grow by just 0.75 per cent.

Speaking at the National MPC Agency briefing, Mr Pill said there is evidence of disinflation in lower wage growth, but said the rate of the slowdown in pay has been lower than the Bank had expected in November.

He said he would caution against very rapid or very large future cuts to interest rates, and added that the central bank is not in a position to declare the “job done”.

Inflation is also expected to “rise quite sharply” later this year as gas prices rise and while a recession is forecast to be narrowly avoided, the figures are far from positive for the Chancellor.

But Mr Pill said the expected rise in inflation this year would probably not lead to second-round price pressures.

In a statement yesterday, Ms Reeves said the interest rate cut was “welcome news” but stressed she was “still not satisfied with the growth rate”.

What impact could Donald Trump and US tariffs have on UK interest rates and inflation?

The interest rate cut comes after a volatile week for the global economy, with the new Trump administration announcing plans for tariffs against China, as well as now-delayed tariffs against Canadian and Mexican imports.

The Bank of England stressed that the latest report had been written before these were announced.

However, it is also indicated that the introduction of tariffs, even if not directly against the UK, could impact global economic growth.

Bank of England governor Andrew Bailey said: “If there were to be tariffs that contributed to a fragmentation of the world economy, that would be negative for growth for the world economy. I hope that doesn’t happen, but that could happen.

“The impacts on inflation are much more ambiguous.

“It depends on the reaction of other countries to the tariffs, whether that leads to a redirection of trade and what impact that has on exchange rates.”

Jabed Ahmed7 February 2025 14:26

Interest rates: Why have they been cut and what does it mean?

The Bank of England cut interest rates to 4.5%, its lowest level since June 2023.

The base rate helps dictate how expensive it is to take out a mortgage or a loan.

Hikes in recent years have left mortgage rates much higher than was normal for most of the last decade.

Mortgage owners on tracker rates will witness a fall in monthly payments by £28.98, according to figures from industry body UK Finance.

However, the latest cut is unlikely to push other mortgage rates down immediately because it was largely expected and therefore priced in to mortgage offers.

The base rate also dictates the interest rates offered by banks on savings accounts, meaning these are likely to fall.

Mortgage rates are still high, but a cut to the base rate is good news for the housing market.

Bank of England governor Andrew Bailey said the interest rate cut is part of efforts to deliver low inflation which is the “foundation of a healthy economy”. However, he also stressed that there will be “bumps in the road”.

Jabed Ahmed7 February 2025 13:53

The Independent view | Bank of England interest rate cuts are a much-needed boost for the economy

Editorial: The quarter percentage point cut surprised no one but it is still more significant than it sounds – and we can expect Rachel Reeves to make the very most of it in the weeks ahead

Jabed Ahmed7 February 2025 13:26

BoE chief economist backs cautious approach to interest rates

Bank of England Chief Economist Huw Pill has backed the cautious approach to interest rates set out by the bank.

Speaking at the National MPC Agency briefing, Mr Pill said there is evidence of disinflation in lower wage growth, but said the rate of the slowdown in pay has been lower than the Bank had expected in November.

He added that the central bank is not in a position to declare the “job done”.

Mr Pill said changes to inflation in the coming months in unlikely to have knock-on effects for the economy.

He said he would caution against very rapid or very large future cuts to interest rates. He said that policymakers agree on the direction of travel for rates, the question is how fast.

Jabed Ahmed7 February 2025 13:26

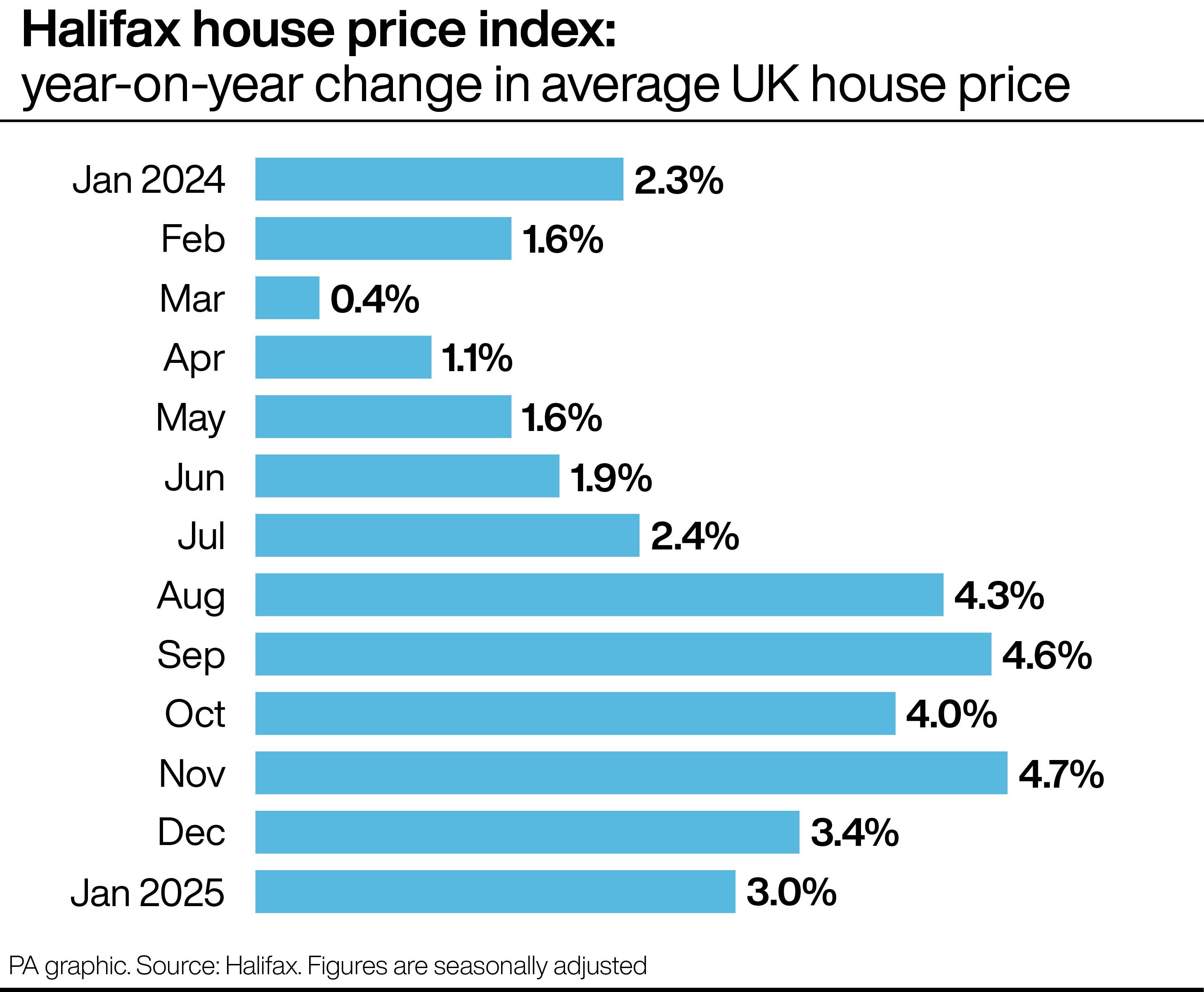

Charted: How have house prices changed in the past year?

Jabed Ahmed7 February 2025 12:58

TSB posts stronger profits despite ‘challenging’ mortgage market

High street lender TSB has revealed a jump in profits for the past year, despite facing a “challenging mortgage market”.

The Spanish-owned bank recorded a pre-tax profit of £290.4 million for 2024, up 22.4 per cent on the previous year.

It said the rise was driven by reductions in the firm’s operating expenses and impairment costs for the year.

Lower restructuring costs helped to offset the impact of higher inflation and the new Bank of England levy, the company added.

Meanwhile, it saw credit impairment charges of £30.1 million, less than half what it reported a year earlier as it benefitted from a reduced risk environment.

It came despite TSB revealing that income fell by 1.4 per cent to £1.14 billion after a reduction in mortgage margins.

Customer lending was up 0.2 per cent year-on-year, as it highlighted “challenging mortgage market” conditions.

Holly Evans7 February 2025 12:55

Mortgage lenders react to house price figures

Earlier today, a Halifax index found UK house prices increased by 0.7% month-on-month in January to reach a new record average high.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “Swap rates (which are used by lenders to price mortgages) continue on a downwards path with some lenders dropping their mortgage rates, in part reversing recent increases.

“The latest rate cut was largely expected by the markets and has been factored into pricing already, but a continual decline in swaps would enable lenders to price more keenly, easing borrowers’ affordability concerns.”

Mark Eaton, chief operating officer at longer-term lender April Mortgages, said: “For hopeful buyers looking to get on to the market, house price growth is making the task of buying a home even more difficult.

“A fall in the base rate yesterday may lead to modest reductions in mortgage rates, but it is unlikely to drastically improve affordability for first-time buyers.”

Jabed Ahmed7 February 2025 12:37

ICYMI | FTSE 100 notches new record after Bank of England cuts rates

The FTSE 100 reached a record high on Thursday after the Bank of England announced that it is cutting interest rates.

London’s blue-chip index gained 104 points to finish the day at 8,727, or a 1.2% rise.

It comes after the Bank cut rates to 4.5%, but presented a gloomy economic outlook for the UK over the next year.

Policymakers said economic growth is going to be half as much as they previously thought, at just 0.75%, while interest rates are going to rise faster than expected.

The pound plunged on the announcement, falling more than 1.1% against the dollar before recovering to about 0.6% down at the close of trading, at 1.244. It was 0.3% down against the euro at 1.199.

Nonetheless, governor Andrew Bailey said the Bank stood ready to cut rates again this year, boosting the FTSE.

Jabed Ahmed7 February 2025 12:02

Mapped: Most expensive region for house prices revealed

House prices across the country have hit record highs and sit just shy of £300,000, according to the latest index.

The average property price in January was £299,138, and on an annual basis, prices rose by 3.0 per cent in the past year, according to Halifax.

Here are the most expensive, and cheapest, regions to buy a house in the UK:

Tom Barnes7 February 2025 11:35

Landlords should foot ‘significant’ part of energy efficiency bill

Landlords should foot a “significant” amount of the bill to meet energy efficiency standards outlined in Government proposals, Ed Miliband has said.

Under the plans put out for consultation, all private landlords in England and Wales will pay a maximum £15,000 cap to meet energy performance certificate (EPC) C or above by the end of the decade.

The Government says the proposals could save renters £240 a year on average on their energy bills, and lift up to half a million households out of fuel poverty, as they will not have to spend so much heating cold, draughty homes.

Landlords would not have to spend more than £15,000 and there is potential for a lower £10,000 cap if renters are charged lower rents or homes are in a lower council tax band under the plans.

EPC E is currently the required level.

Landlords have said a “realistic timetable” is needed to meet the higher rating after the Government announcement.

Holly Evans7 February 2025 11:14