Shorouk Express

Britain has seen a surge in million-pound homes, with their numbers increasing by approximately a third in the last five years.

That’s according to estimates from property firm Savills.

Around 702,580 properties across the country are now valued at £1 million or more, representing a net gain of 3,127 such homes in 2024 compared to 2023. This means one in every 42 homes in Britain reaching the million-pound mark.

London spearheaded this growth, boasting the largest increase in million-pound homes last year. The capital now has a record 349,068 properties valued at £1 million or more, meaning one in every 11 homes in London falls into this category.

However, this trend was not uniform across the UK. Outside of London, the number of million-pound properties actually experienced a slight decline of 1% last year, highlighting a significant regional disparity in the property market’s performance.

open image in gallery

Lucian Cook, head of residential research at Savills, said: “Growth has been limited by higher mortgage costs and stretched affordability, further reducing some of the gains made over the course of the pandemic in suburban and rural areas.

“However, increased demand for city living driven by the return-to-work movement has re-balanced the market back in favour of London homeowners, with 5,000 properties crossing the £1 million threshold in 2024.”

Outside of London, one in every 73 homes are worth £1 million-plus, Savills estimated.

open image in gallery

In percentage terms, the North East of England saw the biggest rise in property millionaires outside of London (a 5.5% increase), although this market still holds the smallest overall market share, the report said.

The West Midlands also saw a big jump, with 918 more million-pound properties last year.

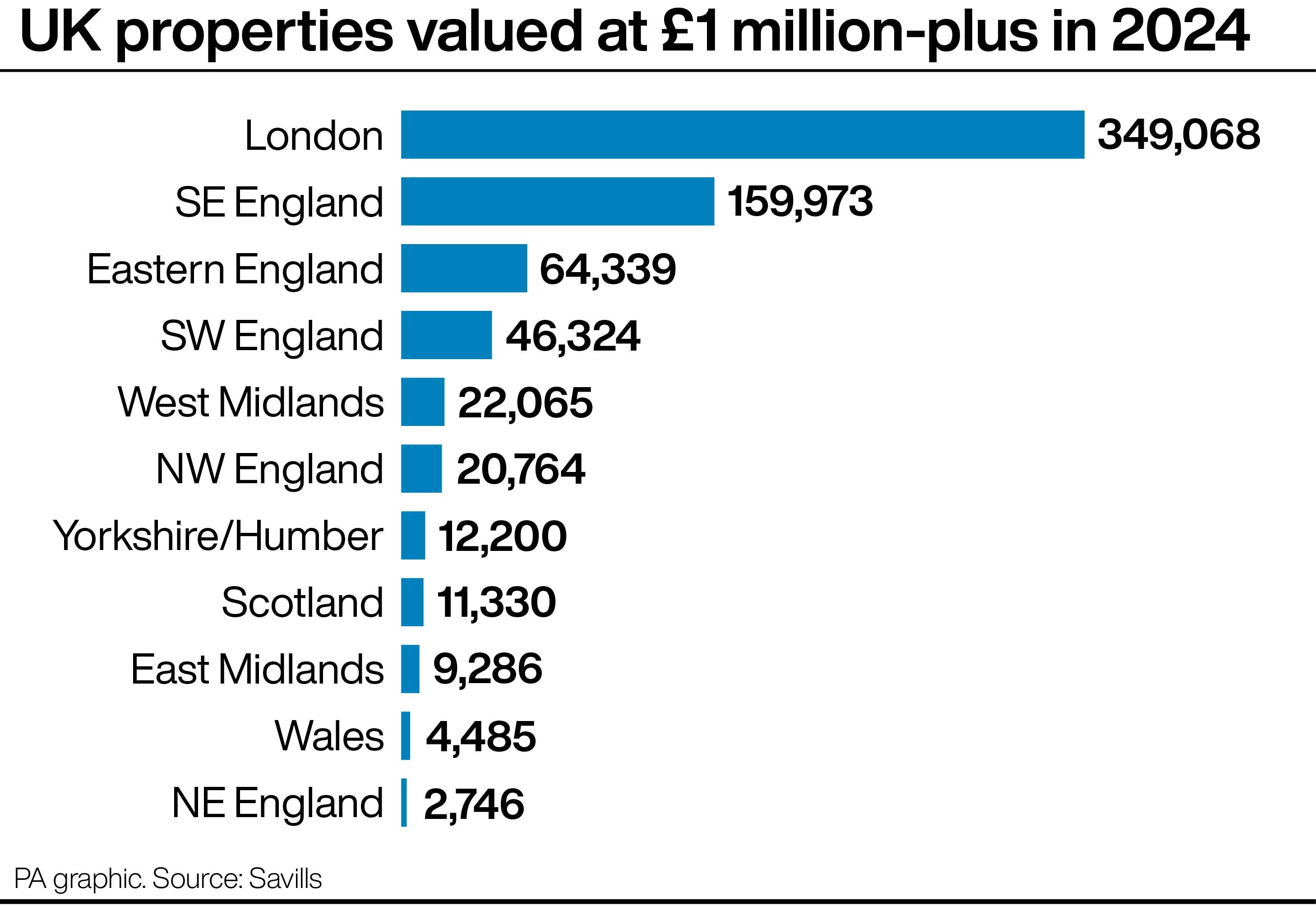

The number of million-pound properties last year

Here are the number of million-pound properties last year, according to Savills, followed by the annual increase or decrease (the property firm stated some of its regional figures may not add up to national totals due to rounding in its calculations):

London, 349,068, 5,202

South East, 159,973, minus 1,902

East of England, 64,339, minus 1,320

South West, 46,324, minus 1,527

West Midlands, 22,065, 918

North West, 20,764, 834

Yorkshire and the Humber, 12,200, 522

Scotland, 11,330, 11

East Midlands, 9,286, 348

Wales, 4,485, minus 100

North East, 2,746, 142

Peter Daborn, director and head of residential sales at Savills in the West Midlands, said: “We see many buyers still taking advantage of flexible working and the appeal of living in the countryside is still a big draw, with London commutable in little over an hour from the likes of Stafford station.

“The recent changes to school fees are also having an impact on the region’s property market, with more buyers driven to the West Midlands to take advantage of the abundance of highly regarded public schools on offer.

“When coupled with the relative affordability in counties like Shropshire and Staffordshire, a new balance is struck, meaning families can still have the complete package of the home, lifestyle, and education they want, without increased financial burden.”

The South East, East of England, the South West and Wales all saw a decline in their £1 million-plus stock, according to the research, which involved looking at the distribution of housing stock by price band and applying price movements from Savills’ prime regional index.

The figures were released as a separate index from property firm Hamptons found that the average tenant moving into a new property in Britain during January 2025 saw the rent they pay rise by 1.8% compared with 12 months ago, marking the slowest rate of growth since October 2020.

Hamptons’ data is taken from property services firm Connells Group.

Tenants renewing a contract continued to see rents rise much faster than tenants moving into new properties.

The average rent for a tenant renewing their contract rose 6.0% across Britain annually, according to Hamptons.

The average monthly rent for a new let was £1,372 while the average monthly let for someone renewing was slightly less, at £1,263, in January 2025.