Shorouk Express

Though some Spanish sectors are less exposed to President Trump’s tariffs than in other European counties, Spain’s so-called ‘Google Tax’ could soon bring it into the crosshairs of Washington.

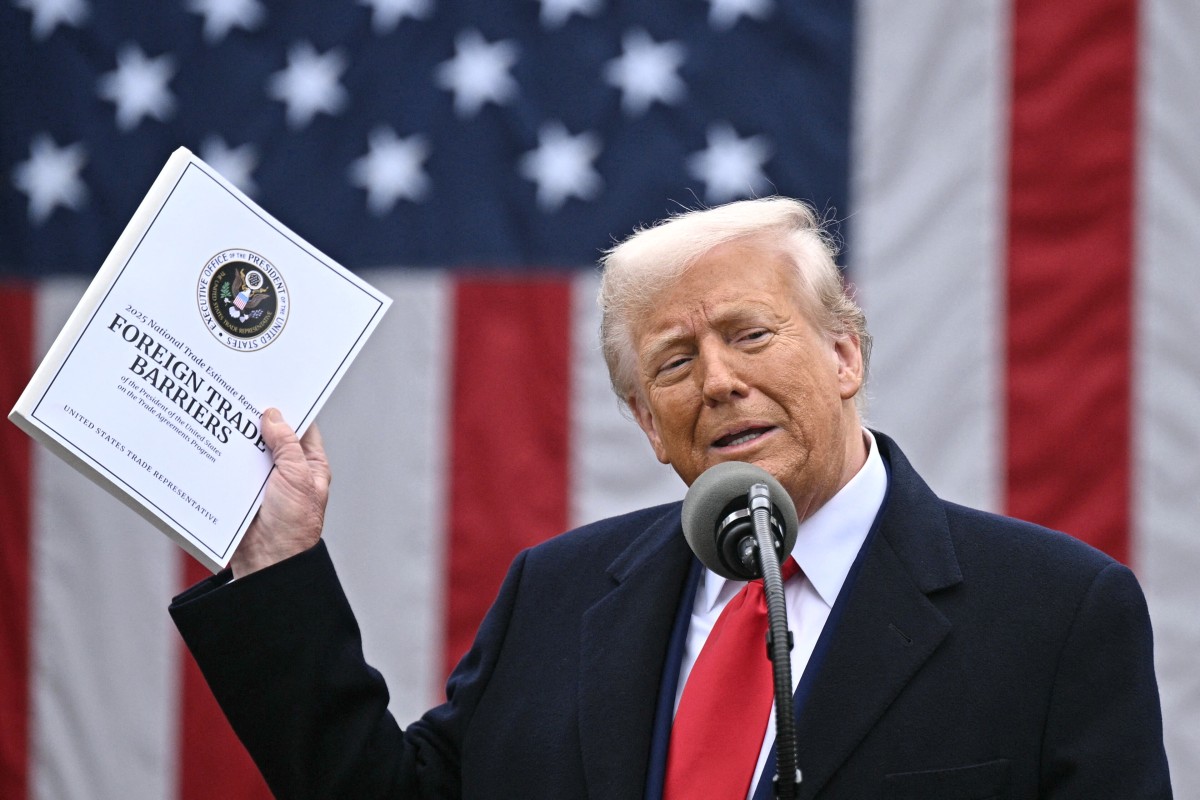

On April 2nd, US President Donald Trump escalated his tariff regime and risked a global trade war by introducing fresh measures on China and the EU on what he dubbed “Liberation Day” for Americans.

The EU was hit with 20 percent tariffs while China faces 34 percent, and this follows a series of pre-existing customs taxes on steel and car parts in recent weeks.

But for some countries in Europe, including Spain, there are fears that trading relationships with Washington could further worsen due to a pre-existing ‘Google Tax’ that Trump wants scrapped.

READ ALSO: Machinery and olive oil – The economic impact of Trump’s tariffs on Spain

Though the Spanish economy is not as exposed to the Trump tariffs as some of its European neighbours, the Google Tax has caught the attention of Washington and could now put Spain at risk of further economic damage.

Trump will soon receive the conclusions of the report he commissioned in February on the impact of the Google Tax in seven countries, notably whether taxes on US tech giants are discriminatory, threaten the intellectual property of the companies, or undermine global competitiveness.

The Google tax is aimed, as the name suggests, at Google, but also other large multinational tech companies such as Amazon and Microsoft, the majority of which are American.

Advertisement

The Spanish tax on digital services or ‘Google tax’ was first rolled out in 2021. It levied a 3 percent tax on the income of technology companies from revenue streams such as online advertising and the sale of user data.

It taxes worldwide revenues in excess of €750 million and turnovers of more than €3 million.

Trump now appears to be turning his attention to this tax. The administration has close ties to big tech moguls, and his inauguration at the White House in January brought many of them together publicly.

In an order signed a few days ago, the US president cited the fact that “foreign governments have exercised increasing extraterritorial authority over US companies, particularly in the technology sector.”

After four years in effect, that tax revenue in Spain is growing but still a long way from the €1 billion estimated by the Ministry of Finance when it was first launched. The tax collected €375 million in 2024, barely a third of forecasts.

Advertisement

From the outset it was met with reluctance in Washington, which considers it discriminatory as the largest tech multinationals in the sector are American.

The idea of a sweeping tech tax was first rolled out at the European level, but the EU struggled to move forward with legislation.

Faced with a stalemate in negotiations on a global scale, several countries — including Spain but also France, Austria and the United Kingdom — unilaterally created their own national taxes. At that time, the pandemic had not yet started, Trump was still serving his first term and Washington responded with retaliatory tariffs, delaying implementation.

In October 2021, however, when Biden’s Democrats arrived in the White House, the US agreed to temporarily pause tariffs in exchange for European countries not introducing any new taxes until a multilateral solution was found.

However no agreement was ever made, and with Trump now returning to the White House for his second term, this seems increasingly unlikely due not only to the President’s aggressive rhetoric on trade and tariffs, but because any agreement without the US would by definition have very limited scope as it is where the world’s largest tech companies are based.

READ ALSO: What impact will Trump’s new oil and car tariffs have on Spain?